About Me

I left home for college planning to be a Navy fighter pilot. Having grown up in a town with fewer people than cows, I craved excitement and adventure and, like my dad, a New York City cop, I was sure I’d never be happy working indoors, and definitely not at a desk.

Now I spend most of my working hours at a desk. Ditto on Wall Street, where I stared at computer screens for fifteen years, and before that pursuing a PhD in physics — a time now lodged in memory as one six-year-long stint of pulling my hair out at a desk.

I never became the swashbuckling hero that I thought dad was and that I’d hoped to be. At some point I realized that the adventures I was more suited for were those in the realm of ideas, especially those amenable to scientific and quantitative thinking.

Besides the need for a paycheck, it was curiosity that brought me to Wall Street, where I’d planned to have a short-lived lark amongst people who found finance interesting — an opinion I wanted to share at the time but didn’t. But a key thing I learned there is that everything is interesting, if you look closely enough. I’d once thought that only physics asked the questions I was most interested in, and that the answers were invariably mathematical. But eventually I learned how narrow that perspective was and also that people don’t really understand in terms of math; they understand in terms of words.

And that is why I write.

Writing

Links to pieces I've published:

my quantum leap

I botched my first interview with Chris Fuchs. Fuchs is a physicist at the University of Massachusetts Boston and the leading proponent of QBism, one of the newest and most controversial of quantum theory’s many interpretations. It goes something like this: Quantum mechanics, the theory physicists use to predict the behavior of elementary particles like electrons and photons that make up matter and light, doesn’t actually pertain to particles, but rather to the beliefs about them of whoever is using the theory. And if several people are using it at the same time? Then QBism says that each of them is entitled not only to their own beliefs, but to their own facts.

The Quantum mechanic

“The thing that amazes me is that quantum mechanics is only 100 years old,” the physicist Angelo Bassi said. We were in conversation across a picnic table on a drab Soviet-era campus in Zagreb, an early-autumn breeze swishing through the yellowing leaves of some nearby trees. “It’s a baby, it’s nothing — 100 years in the history of science. How can you just stop there? It doesn’t make sense any way you look at it.” We sat in the shadow of a rust-stained beige building where Bassi was about to speak at a workshop for physicists who specialize in the century-old subject.

Despite the theory’s advancing years, even college-educated adults tend to have only a hazy sense of what quantum mechanics says. And for good reason…

new clues in the hunt for a room temperature superconductor

Experimental physicist Maddury Somayazulu could only hope that being close would be good enough. In an equipment-crammed room at Argonne National Laboratory in Illinois, he was huddled with postdoctoral researcher Zachary Geballe over a plum-sized cylindrical gadget called a diamond anvil cell. Inside was a dust speck’s worth of the rare-earth metal lanthanum and a bit of hydrogen gas, which theorists had predicted could morph into a novel compound under the enormous pressure of 2.1 million atmospheres. That is more than half the pressure at the center of Earth and, more relevant on that June 2017 day, near the limits of the cell’s capacity to compress its contents between its two pebble-sized diamonds…

Reality's whispers

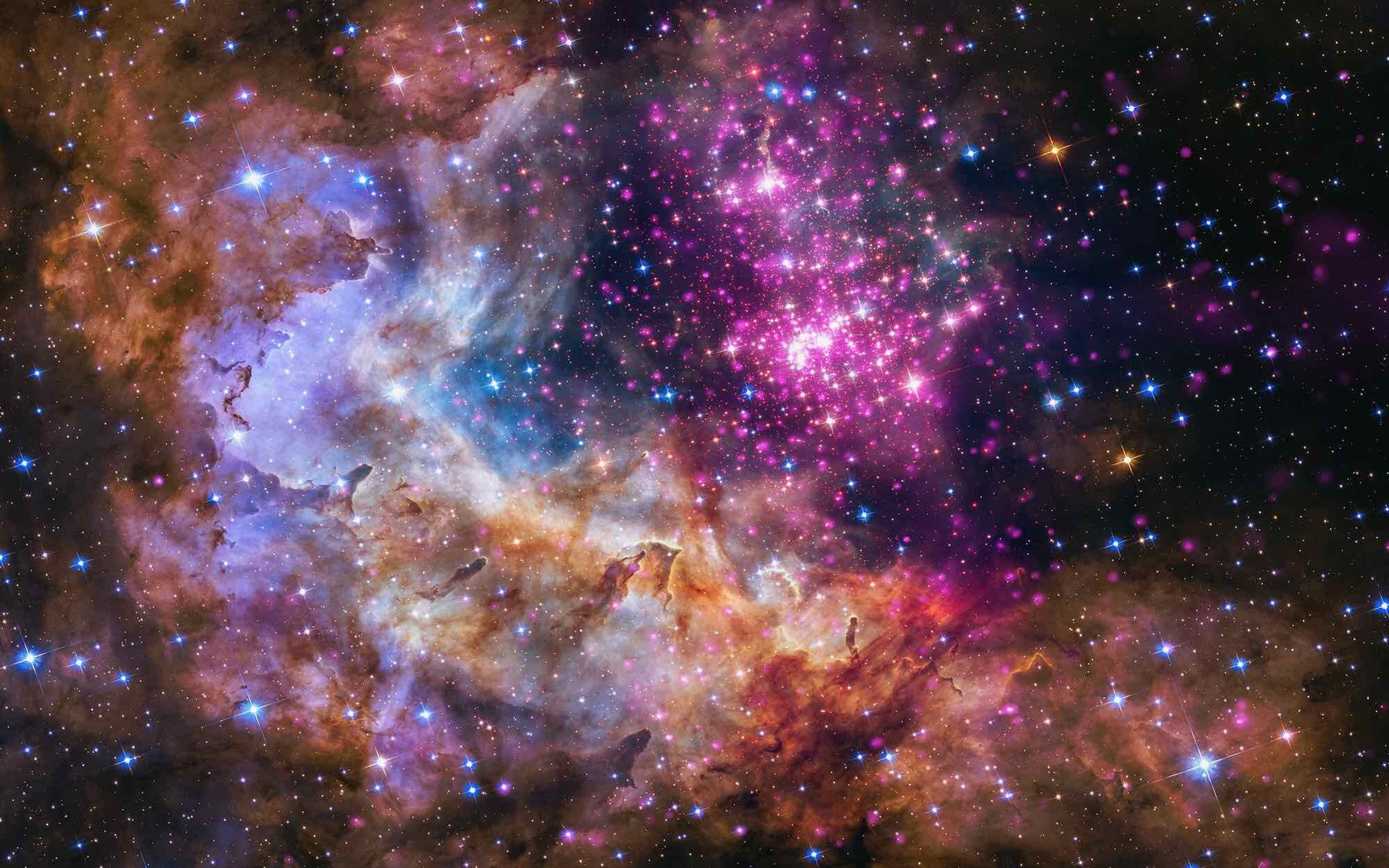

NATURE gives rise to weird and wonderful things: dancing plants, sailing stones, flamingos. But no one, except perhaps on a hallucinogenic trip, has seen a flamingo melt into a wave or split itself into multiple copies. And that may be the weirdest thing of all, since our best theory of nature seems to suggest those things could happen.

exoplanet everests may be detectable when giant telescopes come online

The Himalayas distort Earth’s surface only about as much as a human hair would that of a billiard ball. Discerning such a minute effect on a planet orbiting another star might seem laughable—akin to perceiving the hair on the ball, with the ball on the moon. Nevertheless, two astronomers have proposed a way to detect mountains and other surface features on exoplanets. And as mind-blowing as that may seem, the researchers have even loftier goals in mind.

How the hidden higgs could reveal our universe's dark sector

The world’s most powerful particle accelerator, the Large Hadron Collider (LHC) at the CERN laboratory near Geneva, has failed to find any of the hoped-for particles that would lead physicists beyond the Standard Model of particle physics. But it’s possible that the LHC has been producing such pivotal new particles all along, and that we’re just not seeing them.

what does any of this have to do with physics?

Have you ever been happy?” My girlfriend asked me that question, after work over drinks at some shiny Manhattan bar, after another stressful day on the trading floor. How to answer that? I knew she was talking about work, but how unhappy did she think I was? I took a sip of single malt scotch and scrolled back through time in my mind until I had it.

It was the spring of ’93, 16 years earlier, at the University of Rochester, where I went to graduate school for physics...

can topology prevent another financial crash?

Could Kevin Bacon have saved us from the 2008 financial crisis? Probably not. But the network science behind six degrees of Kevin Bacon just well may have. According to the famous saying, every movie actor is separated from Kevin Bacon by six degrees of separation or less, going from co-star to co-star (actually most are separated from Bacon by only three degrees). Actors form a “small-world” network, meaning it takes a surprisingly small number of connections to get from any one member to any other.

what I learned from losing $200 million

I’d lost almost $200 million in October. November wasn’t looking any better. It was 2008, after the Lehman Brothers bankruptcy. Markets were in turmoil. Banks were failing left and right. I worked at a major investment bank, and while I didn’t think the disastrous deal I’d done would cause its collapse, my losses were quickly decimating its commodities profits for the year, along with the potential pay of my more profitable colleagues. I thought my career could be over. I’d already started to feel those other traders and salespeople keeping their distance, as if I’d contracted a disease.

the admiral of the string theory wars

Watching Peter Woit lecture on quantum mechanics to a class at Columbia University—speaking softly, tapping out equations on a blackboard—it’s hard to imagine why a Harvard physicist once publicly compared him to a terrorist and called for his death. “I was worried,” said Woit’s longtime girlfriend, Pamela Cruz. “Sleep was lost.”

a night with the nypd

“Jesus Christ, use your head!” the sergeant at the wheel cries at a car lingering in front of him. He hits his siren – Whoop! Whoop! – and inches past the offending vehicle. It’s 5:45 p.m. in the Bronx, and the sergeant, partnered with a rookie fresh out of the police academy, is on his way to the evening’s first call, a 3-4: assault in progress. The sergeant hits the gas and the colorful storefronts outside blend into a blur.

Interviews

Interviews by me, and of me.

K Factor

A podcast in which I'm interviewed about my experience losing $300 million as a Wall Street trader during the financial crisis.

to become a better investor, think like darwin

You tell me: How many investors do you know who would be perfectly happy and calm about watching half of their investment evaporate before their very eyes, while at the same time listening to news reports about Lehman going under, about Bernie Madoff in December of 2008, about financial markets coming to a halt, about Hank Paulson showing up on TV with a frightened face? If you think about how humans react, the advice that we give them—while it may be good advice if we really, truly stuck to it—it’s not realistic to expect humans to act in that way. That’s really the failing of the standard approach to passive investing. It’s advice that we know for a fact people are not going to take.

Don’t Tell Your Friends They’re Lucky

Cornell professor of economics Robert Frank says he’s alive today because of “pure dumb luck.” In 2007, he collapsed on a tennis court, struck down by what was later diagnosed as a case of sudden cardiac death, something only 2 percent of victims survive. Frank survived because, even though the nearest hospital was 5 miles away, an ambulance just happened to be responding to another call a few hundred yards away at the time. Since the other call wasn’t as serious, the ambulance was able to change course and save Frank.

A Real-Life Trader Talks About “The Big Short”

Because he had no background in the product he bought, so I completely sympathize with his skeptical colleagues. If you just go in there as an amateur, you're probably going to lose, and he was effectively going into the mortgage market as an amateur. He trained himself and really looked into these products in a way nobody else had, but his older colleagues, with decades of experience, thought he was betting against basically the whole world, betting against what everyone thought was a perpetually solid housing economy and all the experts. So I have to admit, unless I had the time and the inclination to do all the same work Burry had done, I wouldn't have trusted him.